Investment Strategy

For clients who recognise the need for a structured and professional approach to investment management, as an integrated part of their pension and investment portfolio, we have designed the following services:

- A segregated investment portfolio tailored to your requirements and specific to your own circumstances.

- Full reporting to you combined with regular review meetings.

- An assessment of your attitude to risk.

- Your personal views and future needs are taken into consideration for capital growth or income and accessibility to your investment.

In summary, we design an investment strategy to suit your particular circumstances.

In order to meet client objectives, an investment portfolio will be constructed by taking into consideration a number of factors such as:

- Asset Allocation.

- Diversification.

- Correlation.

- Reviewing your Portfolio.

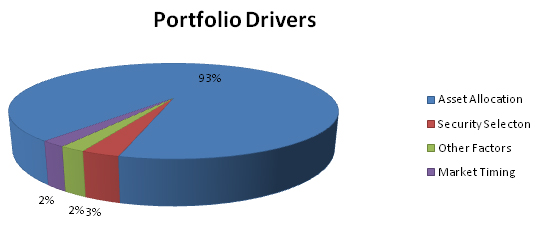

Investment research has shown that:

“The asset allocation decision is by far the most important factor in determining returns.” (Sandler Report)

In the Journal of Finance, Messrs. Brinson, Bush & Beebower cite the relative importance of portfolio drivers:

Some of the Investments carried out

- ISAs.

- Regular Savings.

- Investment Bonds.

- Offshore Bonds.

- Unit Trusts & OEICs.

- Fund Management.

- Investment Trusts.